nd sales tax calculator

Plus Tax Amount 000. 31 rows The state sales tax rate in North Dakota is 5000.

Sales Taxes In The United States Wikipedia

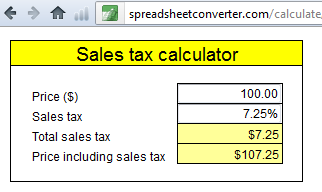

The calculator will show you the total sales tax amount as well as the.

. Maximum Possible Sales Tax. 2022 North Dakota state sales tax. Kathryn is located within Barnes County North.

Fargo is located within Cass County North Dakota. The average cumulative sales tax rate in Harwood North Dakota is 55. Divide tax percentage by 100.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 536 in Mountrail County. Before Tax Amount 000. Minus Tax Amount 000.

North Dakota State Sales Tax. Calculate Car Sales Tax in North Dakota Example. Average Local State Sales Tax.

Depending on local municipalities the total tax rate can be as high as 85. Multiply price by decimal. This includes the rates on the state county city and special levels.

With local taxes the total sales tax rate is between 5000 and 8500. This includes the rates on the state county city and special levels. The North Dakota ND state sales tax rate is currently 5.

Maximum Possible Sales Tax. To find the total sales tax rate combine the North Dakota state sales tax rate of 5 and look up the local sales tax rate with TaxJars Sales Tax Calculator. Wishek North Dakota Sales Tax Calculator.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is. The North Dakota sales tax rate is 5. Your household income location filing status and number of personal exemptions.

Sales Tax Table For Mountrail County North Dakota. 65 100 0065. Before Tax Amount 000.

Harwood is located within Cass County North. How much is sales tax in North Dakota. The average cumulative sales tax rate in Fargo North Dakota is 75.

Minus Tax Amount 000. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. With local taxes the total sales tax rate is.

North Dakota assesses local tax at the city and county. You can use our North Dakota Sales Tax Calculator to look up sales tax rates in North Dakota by address zip code. The average cumulative sales tax rate in Kathryn North Dakota is 5.

The base state sales tax rate in North Dakota is 5. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The price of the coffee maker is 70 and your state sales tax is 65.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota. Maximum Local Sales Tax. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

Maximum Local Sales Tax. List price is 90 and tax percentage is 65. Sales Tax 30000 -.

Exact tax amount may vary for different items. Williston North Dakota Sales Tax Calculator. Average Local State Sales Tax.

Plus Tax Amount 000. North Dakota State Sales Tax. This includes the rates on the state county city and special levels.

Create A Simple Sales Tax Calculator Spreadsheetconverter

How To Calculate Cannabis Taxes At Your Dispensary

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

North Dakota Income Tax Calculator Smartasset

Understanding California S Sales Tax

North Dakota Income Tax Calculator Smartasset

How To Add Sales Tax 7 Steps With Pictures Wikihow

Property Tax Information West Fargo Nd

2022 Property Taxes By State Report Propertyshark

States With The Highest Lowest Tax Rates

Online Sales Tax In 2022 For Ecommerce Businesses By State

4 Ways To Calculate Sales Tax Wikihow

North Dakota Sales Tax Rates By City October 2022

General Sales Taxes And Gross Receipts Taxes Urban Institute

The Ultimate Guide To North Dakota Real Estate Taxes

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Alcohol Taxes Make Illinois Independence Day Celebrations Costlier